Encourage social dialogue and stakeholder engagement

Galp aims to foster closer connections and relationships with customers, suppliers, partners, communities, governments, academia and other relevant stakeholders. Their insights present opportunities for mutual value creation that will benefit both the company and society.

Our stakeholders

We cultivate long-term partnerships with the countries and communities where we operate, to create value and mutual trust. Our key stakeholders can be grouped in four main groups with different purposes of engagement.

Engagement with Employees

Engagement with employees is essential to fostering a motivated, committed, and productive workforce that contributes to organizational success, while also ensuring a safe and healthy workplace that respects human rights.

Engagement takes place through key dialogue channels, including Town Hall events open to all employees across all geographies. These events cover topics such as the current context, future challenges, business evolution, the new governance structure and the need for business continuity. Additionally, we conduct employee engagement surveys and individual feedback sessions, and an online employee clarification platform is available to all.

Engagement with Clients

Engaging with clients is essential to building strong relationships, understanding their needs, and delivering value to enhance satisfaction and foster long-term loyalty. We actively involve customers and consumers—who are crucial to our company’s growth and longevity—through key dialogue channels such as customer satisfaction and experience surveys and call centers. By listening, understanding, and addressing their interests, needs, and expectations, we uphold principles of ethics, conduct, and transparency.

Engagement with Investors

Engaging with investors is essential to promoting trust and maintaining transparent communication, ensuring compliance while keeping stakeholders informed about the company's performance and strategic direction. By strengthening partnerships that support Galp’s financial strategy and project execution, we build long-term collaboration.

We maintain open dialogue through key channels, including regular engagement with investors and analysts, periodic market updates, quarterly results presentations and conference calls. Additionally in 2024 we collaborated with associations such as WBCSD, BCSD Portugal and UN Global Compact. These interactions provided valuable opportunities to exchange knowledge, participate in discussions, and influence important issues.

Engagement with Society

Engaging with society is essential to securing our license to operate, fostering community development, and making a positive impact. We build strong partnerships with suppliers and business partners to ensure reliable value chains and mutual growth while collaborating on industry goals, anticipating trends, and supporting relevant policies and regulations.

We also drive innovation through collaborative research and by leveraging diverse expertise. Our key dialogue channels include membership and participation in sector and technical association meetings, partnerships with NGOs, academic institutions, and research centers, as well as collaborative meetings with business partners. Additionally, we maintain quality and encourage continuous improvement through supplier audits, tender processes, and satisfaction surveys.

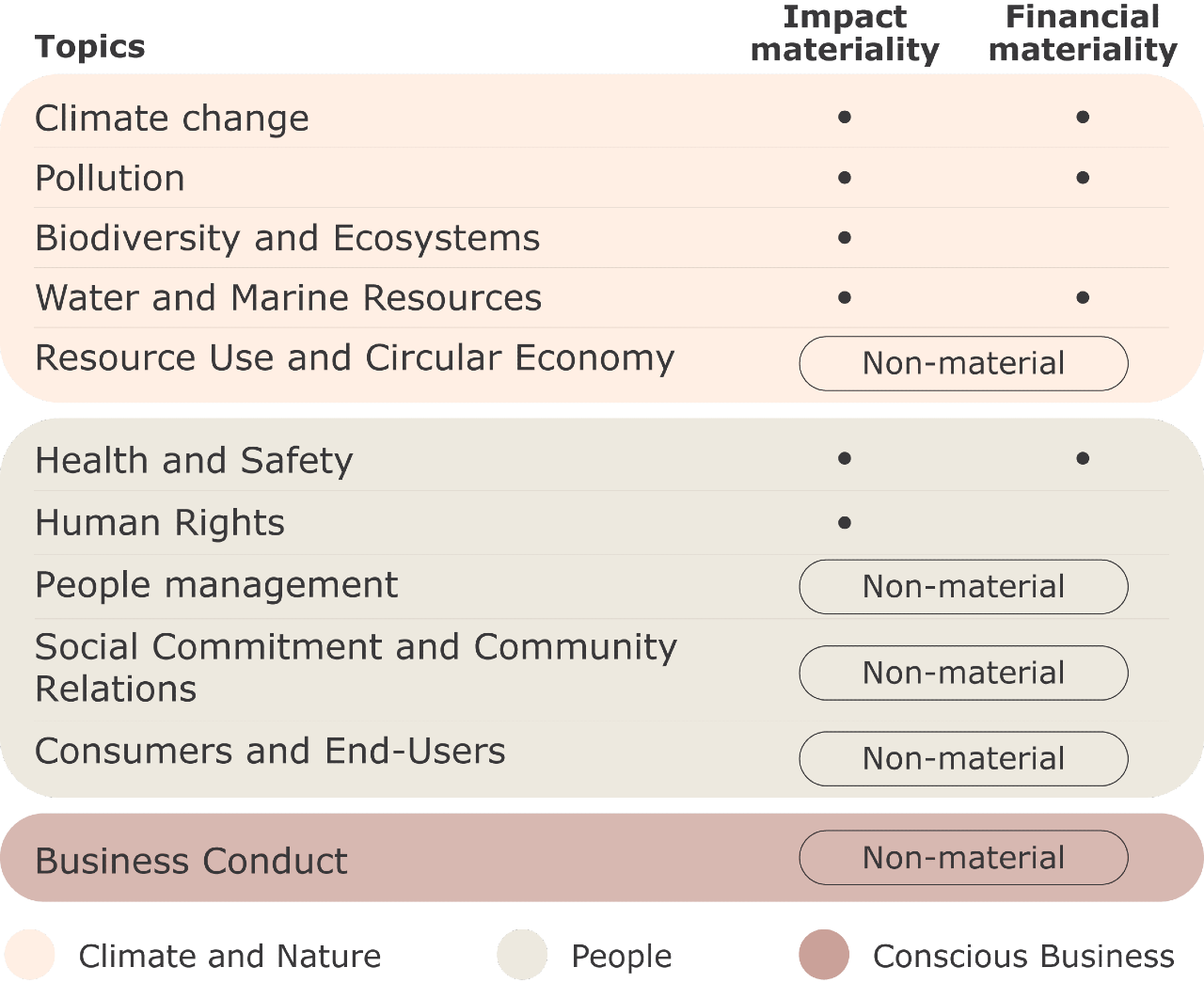

Double materiality assessment

In 2024, we completed our first Double Materiality Assessment, aligned with the new requirements of the EU Corporate Sustainability Reporting Directive (CSRD).

This process enabled us to identify and prioritise the sustainability topics most critical to our business by incorporating the perspectives of our stakeholders. The assessment identified topics with both impact and financial materiality, which have been embedded in our Sustainability Roadmap and for which Galp has established clear goals and targets. Progress on these commitments is regularly monitored and publicly disclosed. Further details can be found at the beginning of each chapter in Part I (Sustainability Statement) of the Annual Report.