Galp and ACS have completed the transaction for the creation of a joint venture (JV) to develop 2.9 GW of solar photovoltaic projects in Spain.

Galp acquired 75.01% of the target solar company, while ACS will keep 24.99%.A joint control governance structure has been set up and the stake will be booked in Galp’s fi-nancial statements under the equity method.

Today’s completion is the outcome of the January 22 agreement with ACS, subse-quently amended, amongst others, to establish a JV between the two parties, as an-nounced in July. All partner and authority approvals have now been received for this amended agreement.

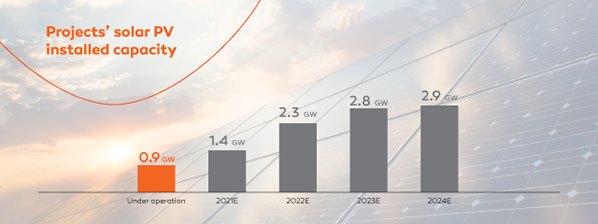

The 2.9 GW portfolio incorporates a selection of high-quality projects spread across Spain. This includes 914 MW of recently commissioned assets and a pipeline with differ-ent stages of development.

Galp and ACS are committed to continue to identify efficient solutions to maximise the projects’ generation capacity, exploring the potential of the premium locations. The development and construction of the portfolio will be made by Cobra, an ACS affiliate with a proven track record on solar developments.

Today, Galp has paid €326 m to ACS for the stake acquisition and development costs associated with the portfolio. The target company currently has €434 m of non-recourse debt related with the operating assets, and the partners intend to project fi-nance the remaining developments. The transaction considers an enterprise value of c.€2.2 bn related with the acquisition, development and construction of the entire port-folio (100%).

Carlos Gomes da Silva, Galp CEO

“The closing of this transaction represents a significant step towards our renewables business ambitions, establishing Galp as the largest solar operator in Iberia through the incorporation of a high-quality generation portfolio, and will be an important part of our energy transition path.”

Citigroup Global Markets and King & Wood Mallesons acted as financial and legal advi-sors, respectively.